Submitted by Dallas Kachan on

It's December, and time for an annual reading of the green [tech industry] tea leaves. What will the new year have in store for cleantech?

From our standpoint at Kachan & Co., 2011 could be a strong year for the global clean technology sector. Seemingly, the markets have been correcting themselves in 2010; valuations are returning to rational P/E multiples, price signals are emerging again after massive government investment in cleantech, early stage deals seem to be returning, corporate investment is flowing, new funds are being announced everywhere. Outside the U.S., which is having an increasingly hard time supporting the sector, cleantech is alive and well, even in exits... albeit mostly in China.

While we're calling a positive 2011 for the industry, the largest risk, to cleantech and every sector in 2011, will continue to be the spectre of another global economic slide: another massive economic "stair-step" downwards prompted by the continued and growing mismatch between global energy supply and demand, food supply and demand, ever-increasing debt and trade deficits, currency revaluation or political/military developments. Any one, or combination of these, could result in another 2008-scale financial crisis, or worse.

Yet, if none of the above make themselves felt, 2011 could be a solid year for worldwide cleantech. Here's why, in our analysis.

Sustained worldwide VC investment in cleantech in 2011

Predictions of cleantech's death, or bubble, are exaggerated, we believe. Kleiner Perkins may be looking to scale back its cleantech investing. But that doesn't mean cleantech companies won't be getting funded, or that the sector is on the downside of a bubble, as some have called it. The big drivers of cleantech remain: resource scarcity and the drive for greater efficiencies, the desire for energy independence, and (dare we say it?) climate change—the latter of which has taken a back seat of late. We predict these drivers—particularly the real or perceived scarcity around oil, rare earth elements and other commodities—will be felt even more acutely in 2011, especially as the Chinese middle class expands, further cementing the demand for and the market validity of clean technologies.

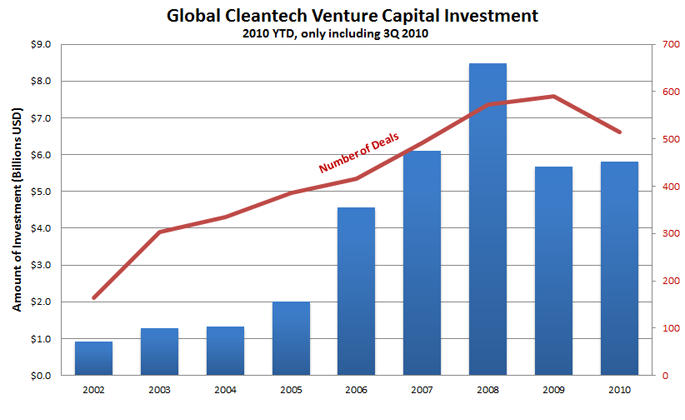

Much media attention was given to a downturn in cleantech investing in the third quarter of this year, in particular North America's share of it. But doomsayers missed that there was still a fourth quarter in 2010 to report. And that worldwide, cleantech investment hasn't fared that poorly in 2010. Indeed, as tracked below, 2010 venture investment in cleantech, even simply up to and including 3Q10, has already exceeded that of all of 2009.

Venture investment in cleantech in 2010, up to and including 3Q10, already exceeded that of all of 2009. The full 2010 total will be at least $1B higher when fully tallied and reported in 2011. That'll make it the second best year on record—hardly a bubble that's burst. Source: Cleantech Group

Venture investment in cleantech in 2010, up to and including 3Q10, already exceeded that of all of 2009. The full 2010 total will be at least $1B higher when fully tallied and reported in 2011. That'll make it the second best year on record—hardly a bubble that's burst. Source: Cleantech Group

We believe venture investors will continue to chase opportunities in cleantech in 2011, investing robust amounts from record-level funds raised recently around the planet. Make no mistake: there's plenty of capital being allocated for cleantech in 2011. Another $500 million has just been announced from the California Public Employees Retirement System (CalPERS). Hony Capital in China is closing in on a new 10 billion RMB ($1.5 billion) fund, and there's a new €9b ($12.4b) NER300 fund for cleantech in the EU. And that's just three of dozens announced in the last month.

Yes, there are concerns about exits and long time horizons in cleantech, but the sheer sizes of the addressable markets many cleantech companies target, and the possibilities for massive associated returns, will continue to draw investors to the sector.

Venture capital will continue to cede importance to corporate and non-institutional capital

As important as venture numbers are, they are no longer the single barometer of the state of worldwide cleantech investment. They don't factor in most angel, project finance, private equity, sovereign and other sources of capital that are now making an impact in cleantech worldwide.

One of the most important sources to watch is corporate venture funding. Look for large companies to invest billions in cleantech in 2011. In recent weeks, Suez Environnement, affiliated with GDF Suez, created a venture capital fund called Blue Orange to invest primarily in waste management. GE invested $200 million+ in a handful of cleantech companies under the auspices of a competition. Corporations continue to form corporate venturing arms, driven not just by returns, but by associated corporate social responsibility (CSR) benefits.

Also anticipate an increase in corporate-led cleantech M&A activity in 2011, which reached record levels in 2010. Expect cash-laden firms to pick off even more leading technologies and concepts, as in recent transactions like Constellation buying CPower, and Sharp's purchase of Recurrent Energy.

A return to early stage venture investments

We predict a return to early stage venture capital investing in cleantech in 2011. Already, in the last few months of 2010, data shows the pendulum has begun to swing back to early stage deals. In the third quarter of 2010, 46 percent of all cleantech deals worldwide were early stage deals, according to latest data.

Why? Investors are no longer piggybacking on U.S. government grants and loan guarantees, which had skewed investment into more mature cleantech companies. Government stimulus funds earmarked for cleantech by the U.S. and other countries globally are now largely allocated. In 2011, venture investment in cleantech will return to what it does best: seeking out emerging early stage technologies and teams that promise good multiples, and will be less influenced by governments putting large amounts of capital to work themselves. Funds are still being raised. And those funds will need to be invested.

Energy efficiency emerges as the clear rock star of cleantech

Yes, we have a broader definition of energy efficiency than others (see our cleantech taxonomy here). But efficiency—including smart grid, where we expect continued massive investment and corporate activity—really just got underway in 2010, so expect big things in 2011. To wit: GE's huge announcements, investments and acquisitions in the third quarter of 2010. And just over a month ago, Russia unveiled a massive energy efficiency plan, given that the country apparently wastes as much energy in a year as the French economy consumes.

There were some calendar quarters in 2010 where more venture investment went into solar than efficiency, but in 2011, look for efficiency to become the clear dominant investment theme as investors continue to seek less capital intensive efficiency plays and eschew solar, where company valuations have been swinging wildly in 2010 from continued supply/demand and international subsidy havoc.

Anticipate a Darwinian winnowing of efficiency companies in 2011—partially because of concerns about differentiation, and partly because of the long sales cycles of utilities that are only starting to become appreciated to some startups. There will be failures in 2011 in certain advanced metering companies and other firms engaged in death-by-trials with utilities, and some winners among favorite brands like OPower, EnergyHub, Tendril, Silver Spring, eMeter, AlertMe, Energate. The deep-pocketed stand the best chance of surviving.

Biofuel investment could reach former highs

If economic growth continues in 2011, oil prices will rise, making renewables more cost competitive. And after several years of relatively inexpensive oil, we predict an upswing in biofuels investment in 2011, specifically, that will catch some unaware; investors still smarting from crop-based ethanol and biodiesel, cellulosic ethanol and algal oil disappointments may not see a drop-in biofuels revolution at hand.

The excitement will not be over cellulosic ethanol, which we saw disappear from headlines in 2010. Cellulosic ethanol may even disappear from investors' portfolios altogether in 2011, if the U.S. EPA lowers its cellulosic ethanol mandates yet again. We believe the recent jump in the share price of Amyris (NASDAQ:AMRS) is representative of a larger awakening to the transportation, storage, energy balance and fungibility benefits of drop-in biofuels, i.e. chemically similar diesel, jet fuel, butanol, bio natural gas and others.

In biofuels in 2011, as elsewhere in cleantech, look for biology to trump chemistry. And for the likes of Amyris, Codexis (NADAQ:CDXS) and Gevo to make more commercial progress than cellulosic companies Range Fuels, Coskata and Mascoma.

Nuclear surprises, but not in U.S.

Expect to hear about more and more nuclear innovation in 2011, as the industry begins cautiously testing new science after decades of relative inactivity. However, don't expect the U.S. to lead in either the science, the trials or the adoption: watch Asia, Europe and Canada as centers of innovation and where trials of new nuclear tech will be performed in 2011. Companies to watch include Thorenco (new reactor designs based on thorium fuel), Thorium One (thorium fuel for existing reactors, trials scheduled to start in existing reactors in 2011), Kurion (glass encasing of nuclear waste), General Fusion and others. Nuclear development will remain stalled in the U.S. in 2011 in regulatory and public opinion purgatory while the rest of the world passes it by.

Recycling and mining will attract more investment

Rising commodity prices have been quietly making the economics of recycling and recovery of trace materials more commercially viable. Silver almost tripled in price in 2010. Gold doubled. Companies that recover and reprocess materials, such as scrap metal, used lithium batteries or mining tailings, will be companies to watch in 2011. BacTech Mining (CVE:BM), Simbol Materials, Buss & Buss Spezialmetalle, DeMetai Technologies, MBA Polymers and GFL Waste & Recycling (which just got a $100m private equity infusion) are examples of companies that could benefit from commodity prices that will continue to rise in 2011. That's barring a macro-economic downturn that, like everything else, whacks the price of commodities (gold bugs note: metals are not immune to market gyrations! Gold fell substantially in the 2008 global downturn).

Natural gas emerges to threaten solar and wind for utility renewable power generation

Renewable natural gas? Today it's fossil-based. But what if chemically identical natural gas (not just messy syngas) could be made inexpensively from practically free feedstock? Such gas, if indistinguishable from petro-based natural gas, could be transported in existing pipelines and sold at a premium to industrial customers like power utilities anxious for a cheaper renewable source than solar and wind. And, if burned in existing IGCC / NGCC plants, such power could be baseload 24/7 renewable energy. Look for scientific innovation in natural gas in 2011, increased political support for it as a transitional "cleaner" fuel, a folding in of it into renewable energy standards and general cleantech industry buzz over it being an important new wagon to hitch to.

China becomes the most important market for cleantech: if you're not selling in China, you won't matter

Expect the leading cleantech IPOs of 2011 to continue to be on the Shenzhen and Hong Kong exchanges, as they were in 2010. Central government support of Chinese clean technology companies on Chinese exchanges will continue to give the country's solar, wind and other vendors advantage in access to capital, growth and, therefore, ability to scale and conquer worldwide.

Kachan & Co. made a case this past August that China had assumed the worldwide leadership position as a cleantech market and supplier. This week, Ernst and Young asserted the same thing. So it's time to underscore it again: if you're not selling into China in 2011, you're missing the biggest market for your clean technology product or service.

in 2011, the leadership of cleantech vendors and service providers will be determined by the extent of their traction in China. It's the largest and the fastest growing market for clean technologies, and to ignore it out of concern for intellectual property or other costs of doing business will be to watch most of one's addressable worldwide market disappear to competitors that will shoulder the costs of business in China.

We'd welcome rhetoric in 2011 being less about how countries could or should compete with China's cleantech leadership, and more focus on how to simply get on with capitalizing on the commercial opportunity that Chinese growth represents. While there's still a worldwide financial system to profit from.

A former managing director of the Cleantech Group, Dallas Kachan is now managing partner of Kachan & Co., a cleantech research and advisory firm that does business worldwide from San Francisco, Toronto and Vancouver. Its staff have been covering, publishing about and helping propel clean technology since 2006. Kachan & Co. offers cleantech research reports, consulting and other services that help accelerate its clients’ success in clean technology. Details at www.kachan.com.