Submitted by Dallas Kachan on

If you've not been paying much attention to cleantech in the last little while, it's time to sit up and take notice.

Because post-Solyndra, cleantech has been quietly gaining momentum.

We had the chance to take a close look at the fundamentals of cleantech over the last two months in co-authoring a new (and free!) 38-page research report in conjunction with Oakland, Calif.-based advocacy group As You Sow and the Responsible Endowments Coalition of Brooklyn, New York.

Titled Cleantech Redefined: Why the next wave of cleantech infrastructure, technology and services will thrive in the twenty first century, the paper analyzes the most recent investment research available across a number of industries and major impact areas. It identifies key drivers and market size projections for various cleantech categories. It looks at examples of products and technologies currently on the market. Finally, it highlights a handful of large, mid and small cap firms and funds as possible points of entry for investors within each industry.

The paper does a good job of introducing cleantech and its significance (e.g. even only being a relatively new investment theme, cleantech is still—even today after a downturn—attracting nearly a quarter of global venture capital available.) It re-emphasizes cleantech's multi-trillion dollar individual addressable markets of power, water, agriculture, transportation and others. And it restates the significance of cleantech's drivers, and that they're not going away any time soon.

But to me, one of the most interesting sections of the report compares the cleantech wave to other technology booms of the last 50 years, like the dot com boom, the networking craze, biotech, the PC and the microprocessor. We found a number of parallels and a number of reasons for optimism when you compare the cycles. After 20 years in technology, personally, the more I looked at the data, the more it felt like I'd seen this movie before.

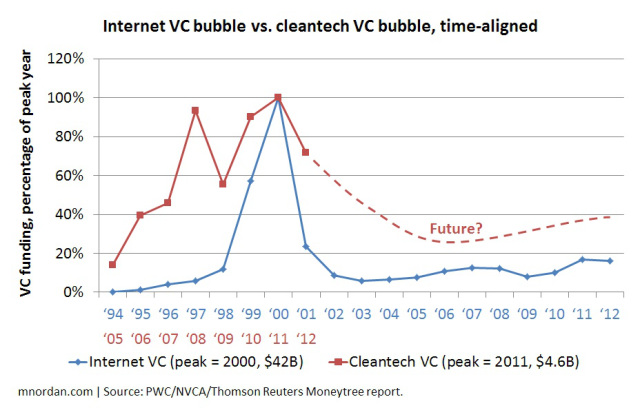

For instance, the downturn in venture capital: Venture capital often spikes early in emerging categories, later to be replaced with more traditional levels of investment and other sources of capital as industries develop. It happened in the Internet era, and this transition has begun in cleantech as shown below; venture capital is playing less of a leading role in driving cutting edge technology, as it's being augmented by corporate investors and other sources of funds. More detail in our report.

Actual and estimated venture capital spending in Internet and cleantech. Source: Matthew Nordan

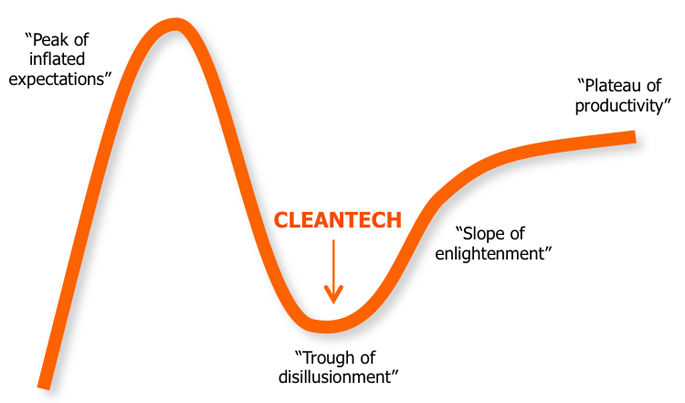

There's another relevant curve, below, that looks a lot like the one above. We hypothesized in an analysis this summer that cleantech had bottomed out on the Gartner hype cycle. We make the more detailed case in our report that cleantech, as in every one of the previous waves I just mentioned, had experienced the same initial enthusiasm, the same frothiness, the same "irrational exuberance" as Alan Greenspan put it, that these other technologies did as expectations initially exceeded reality.

As the Gartner model below illustrates, in every one of these previous waves, there was a correction, and a gradual equalization of expectations and execution. Our analysis, detailed in our report, is that cleantech is now starting to climb out of what Gartner calls the "trough of disillusionment" and up the "slope of enlightenment" (how very Zen!)

Hype cycle of expectations over time related to cleantech. Source: Gartner

And cleantech IS climbing out. If you look at broad-based cleantech funds as a proxy for the cleantech theme, there's been solid growth the last few months. Yes, cleantech returns have been generally poor for investors the last few years. But there HAVE been bright spots in certain sub-sectors such as clean energy generation, solar services and transportation. The lift from high cleantech fliers like SolarCity (NASDAQ: SCTY) and Tesla Motors (NASDAQ: TSA) is pulling up the rest of the category, as shown in the performance of the PowerShares Cleantech Portfolio fund, a mix of public stocks from across the cleantech definition.

PowerShares Cleantech Portfolio fund (PZD) performance, 2007 to 2013. Source: Google Finance

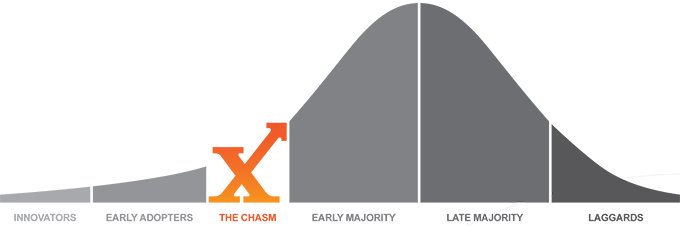

Another reason our report finds optimism for the cleantech space is in looking at cleantech's various industries through the lens of the technology adoption lifecycle model, a curve popularized by the marketing strategy firm Regis McKenna in Palo Alto, California, where I served as a senior consultant in the mid 90s. I wrote in 2011 about the significance of this model to cleantech, and our new report echoes and expands on this analysis. If the vast majority of clean technologies, services and infrastructure plays have yet to cross the chasm, it means risk and expense getting there, but it also means massively larger market adoption on the other side.

In the widely accepted technology adoption lifecycle model, a market gap exists between early adopters of new technologies and the majority of consumers. This gap is especially treacherous for companies that develop disruptive technologies, as they force a significant change to the markets they target. Only companies nimble enough to transition from the early adopter market (consumers motivated by purchasing the latest technologies for competitive benefit) to the early majority of the vastly larger mainstream market (which prefers to buy established technology) are successful.

The technology adoption lifecycle and chasm model, Regis McKenna. Source: Joe M. Bohlen, George M. Beal and Everett M. Rogers

Different clean technologies have faced their mainstream adoption chasms at different times. For example, wind and solar energy power generation have already bridged the gap. They are now widely understood and increasingly deployed by renewable energy decision makers at power companies, and by individual businesses and homeowners. Algae fuel, for example, is on the far left side of the chart—exciting but yet to scale.

The adoption chasm of new technologies can differ substantially in magnitude. Many cleantech products have been quietly moving the needle on efficiency and waste reduction without fundamentally altering their markets. Lighting is a good example. The transition from incandescent to fluorescents to light emitting diodes (LED) happened without dramatic market disruption. Consumers had a small technology curve to overcome, but the lighting market still requires the purchase of light bulbs. We expect a significant segment of the cleantech transition will happen in this way, with cost and efficiency driving marginal, but resource-significant product changes.

So, in all, our new report finds that cleantech is here, today, now. It observes that efficiency, one of the central tenets of cleantech, is now a theme of almost everything now made, and of how it's designed and manufactured. Cleantech is becoming ubiquitous—from cheaper, more efficient lighting to advanced metering software. Cleantech in all of its forms is poised for even more rapid expansion, especially now that the largest companies in the world have discovered the opportunity and imperative of cost savings... and now that individual technologies are beginning to cross the chasm to mainstream adoption.

As our report concludes, we're just at the beginning of this phenomenon called cleantech. The best and most exciting investment opportunities are yet to come.

A former managing director of the Cleantech Group, Dallas Kachan is now managing partner of Kachan & Co., a cleantech research and advisory firm that does business worldwide from San Francisco, Toronto and Vancouver. The company publishes research on clean technology companies and future trends, offers cleantech data and analysis via its Cleantech Watch™ service and offers consulting services to large corporations, governments, service providers and cleantech vendors. Kachan staff have been covering, publishing about and helping propel clean technology since 2006. Details at www.kachan.com.

Add new comment